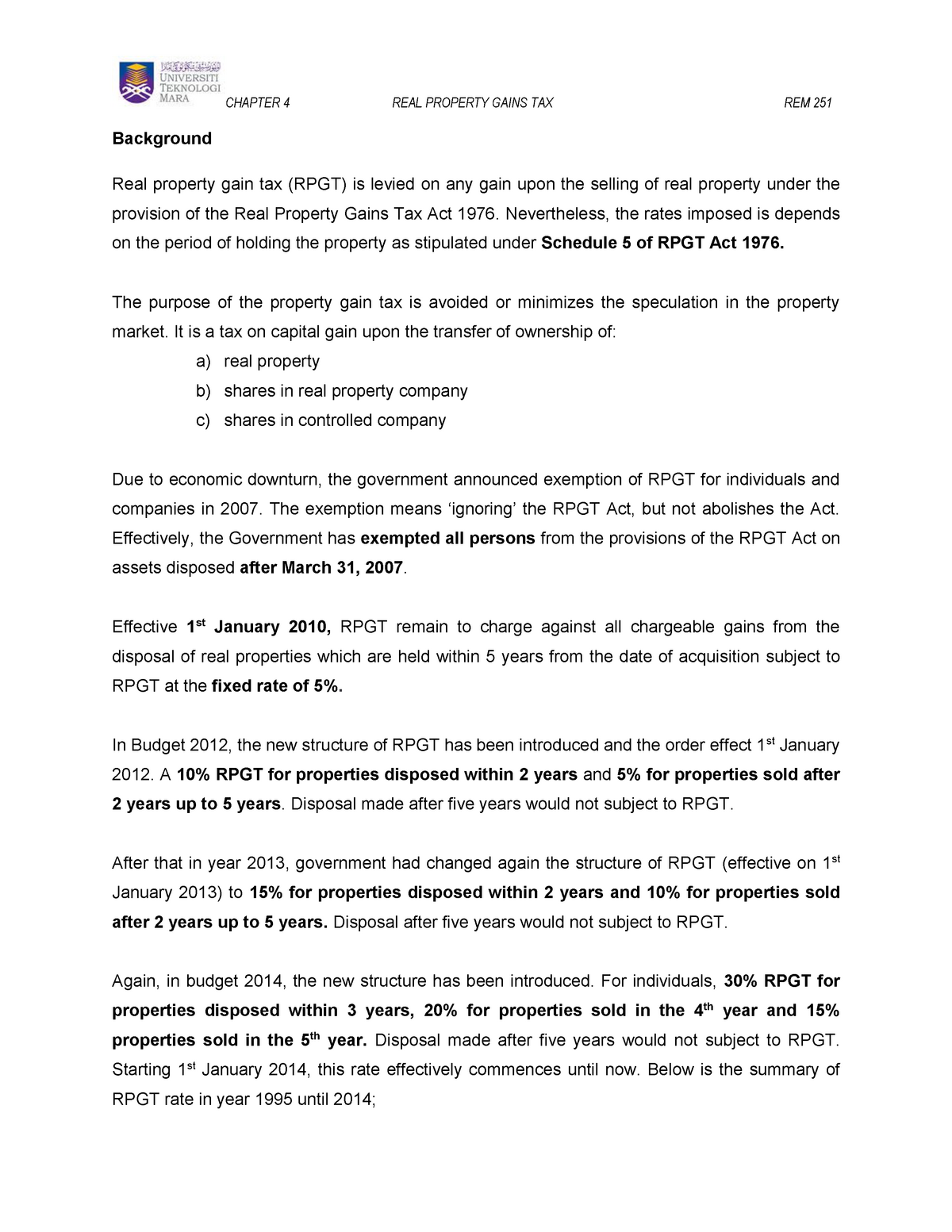

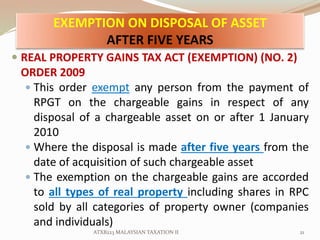

disposal of asset under the real property gains tax act 1976 ????

Find stories updates and expert opinion. Chapter 7 of Part 13 of CTA 2009.

Did You Know That You Need To Pay Real Property Gains Tax If You Made A Profit From Sale Of Your Property Case Facts By Hhq Law Firm In

Oak leases land for use in its business.

. While a trust is revocable rights of the beneficiaries are subject to the control of and the duties. Latest news expert advice and information on money. 1 Tax products developed and prescribed by Media and Publications.

2 Subject to this Act the tax shall be charged on every ringgit. Additional deduction under section 1087 of CTA 2009. With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong.

A lease and a transfer of ownership of the asset or the property that should be recorded in separate documents. 18 or 28 for capital gains relating to residential property. This page is currently under maintenance.

2421 Extension 4 Jerusalem Post or 03-7619056 Fax. Restriction on losses carried forward where tax credit claimed. For exchanges of real property used in a trade or business and other noncapital assets enter the gain or loss from Form 8824 if any on Form 4797 line 5 or line 16.

Real Property Gains Tax RPGT 3 of assets disposal value withheld by purchaser under section 21B of RPGT 1976 CKHT 502 Form. A student will learn what an asset and a liability are what the basic financial statements are how financial statements are developed from the underlying accounting information of a company and how the basic transactions of a business affect each line item of each financial statement. The bank would act as the capital partner in mudarabah accounts with the depositor on one side and the.

States it is the 34th-largest by area and with a population of nearly 118 million is the seventh-most populous and tenth-most densely populatedThe states capital and largest city is Columbus with the Columbus metro area Greater Cincinnati and Greater Cleveland being the largest. Disposal Date And Acquisition Date. Credit under Chapter 2 of Part 2 to be allowed first.

1976 Code Section 62-7-602e. Commercial Code in the revised version published in the Bundesgesetzblatt BGBl Federal Law Gazette Part III Section 4100-1 Book 1 as amended by Article 11 of the Act of 18 July 2017 Federal Law Gazette Part I p. And the employment tax regime under section 3121v.

The disposal of assets which have been held since before 20 September 1985 when capital gains tax went into effect are exempt from CGT. Income tax is payable on assessable income which falls under two broad categories. Commercial Code Handelsgesetzbuch HGB Full citation.

Tax credit under section 1054 of CTA 2009. Ordinary income Income Tax Assessment Act 1997 Cth s 65ITAA97 and statutory income. 1 A tax to be called real property gains tax shall be charged in accordance with this Act in respect of chargeable gain accruing on the disposal of any real property hereinafter referred to as chargeable asset.

CHAPTER 10 Remediation of contaminated or derelict. 1 Research projects studies and tests support effective and efficient decision making in the Internal Revenue Service IRS. RPGT is extended to gain from disposal of shares in real property company RPC ASSET includes any land situated in Malaysia and any interest option or other right in or over such land.

Reference to the updated Income Tax Act 1967 which incorporates the latest amendments last updated 1 March 2021 made by Finance Act 2017 Act 785 can be accessed through the Attorney Generals Chamber Official Portal at the. Curbing black money generation through disclosure of foreign assets Benami Property Amendment Act 2016 and amendments in Double Taxation Avoidance Agreements signed with Mauritius Singapore and Cyprus. This part Regulation Y is issued by the Board of Governors of the Federal Reserve System Board under section 5b of the Bank Holding Company Act of 1956 as amended 12 USC.

Tax Tax home Capital gains Income tax Inheritance tax Tax news. 13 joint venture means an enterprise carried on by two or more persons in common otherwise than as a partnership. Income tax means income tax imposed as such by this Act as assessed under this Act but does not include dividend withholding tax or salary or wages tax and includes specific gains tax.

ASCII characters only characters found on a standard US keyboard. Under state law owners of real property become liable incur a lien on the property for real estate taxes for the year on January 1 of that year. Amount of tax credit.

Oak Corporation is a calendar year taxpayer that uses an accrual method of accounting. In Malaysia for example. IRM 121223 Policy Statement 1-156.

IRM 12123 Policy Statement 1-3 Rev. Section 7j13 of the Federal Deposit Insurance Act. Cut to income tax in doubt under new.

Ohio oʊ ˈ h aɪ oʊ is a state in the Midwestern region of the United StatesOf the fifty US. These changes were consolidated by the Income and Corporation Taxes Act 1970. Other public use forms require approval.

Schedule B was abolished in 1988 Schedule C in 1996 and Schedule E in 2003. A major drive to replace cash transactions by digital transactions is also under way. Commencing from April 1 st 2021 IBRM payment counters in Kuala Lumpur Kuching and Kota Kinabalu will only accept payments of.

The tax applies only on the disposal of a capital asset and. IRM 121221 Policy Statement 1-124 Rev. 100 Section 2 eff January 1 2014.

Taxation of chargeable gains 3. Provisions about the deemed tax under section 139. Real Property Gains Tax RPGT Rates.

Capital gains tax credit etc for special withholding tax. Use of musharaka is not great. Also the schedules under which tax is levied have changed.

2745 Book 2 as amended by Article 14 of the Act of 22 December 2020 Federal Law Gazette Part I. Use Form 8824 Like-Kind Exchanges to report exchanges of qualifying business or investment real property for real property of a like kind. Sections 8 and 13a of the International Banking Act of 1978 12 USC.

Latest breaking news including politics crime and celebrity. Get the latest international news and world events from Asia Europe the Middle East and more. 6 to 30 characters long.

Calculation of income or gain on remittance basis where special withholding tax levied. Tax credit under section 1054 of CTA 2009. Pensions property and more.

Letters of credit and the purchase or real estate or property. Amount and application of the deemed tax under section 137. Real Property Gains Tax RPGT is administered by Inland Revenue Board of Malaysia under the Real Property Gains Tax Act 1976 RPGTA 1976.

The Jerusalem Post Customer Service Center can be contacted with any questions or requests. Must contain at least 4 different symbols.

Malaysia Law Firm With More Than 30 Lawyers Since 2009 In Pj Kl Johor Penang Perak Negeri Sembilan

What Is Real Property Gains Tax Rpgt In Malaysia 2021

What Is Real Property Gains Tax Rpgt In Malaysia 2021

page0.png)

Solution Topic 7 Real Property Gains Tax Rpgt Studypool

Real Property Gains Tax Part 1 Acca Global

Malaysia Law Firm With More Than 30 Lawyers Since 2009 In Pj Kl Johor Penang Perak Negeri Sembilan

2022 Updates On Real Property Gain Tax Rpgt Property Taxes Malaysia

What We Need To Know About Rpgt

Finance Bill 2021 Proposed Amendments To The Real Property Gains Tax Act 1976 Lexology

page1.png)

Solution Topic 7 Real Property Gains Tax Rpgt Studypool

Real Property Gains Tax Rpgt In Malaysia 2022

Property Law In Malaysia Real Property Gains Tax Rpgt For Disposal Of Properties Chia Lee Associates

Amendment Bill To The Real Property Gains Tax Act 1976 And Stamp Act 1949 News Articles By Hhq Law Firm In Kl Malaysia

Amendments To The Stamp Act 1949 And Real Property Gains Tax Act 1976 Shearn Delamore Co

What Is Real Property Gains Tax Rpgt In Malaysia 2021

Chapter 4 Untuk Dijadikan Rujukan And Contoh Kepada Pelajar Pelajar Uitm Diseluruh Malaysia Studocu

0 Response to "disposal of asset under the real property gains tax act 1976 ????"

Post a Comment